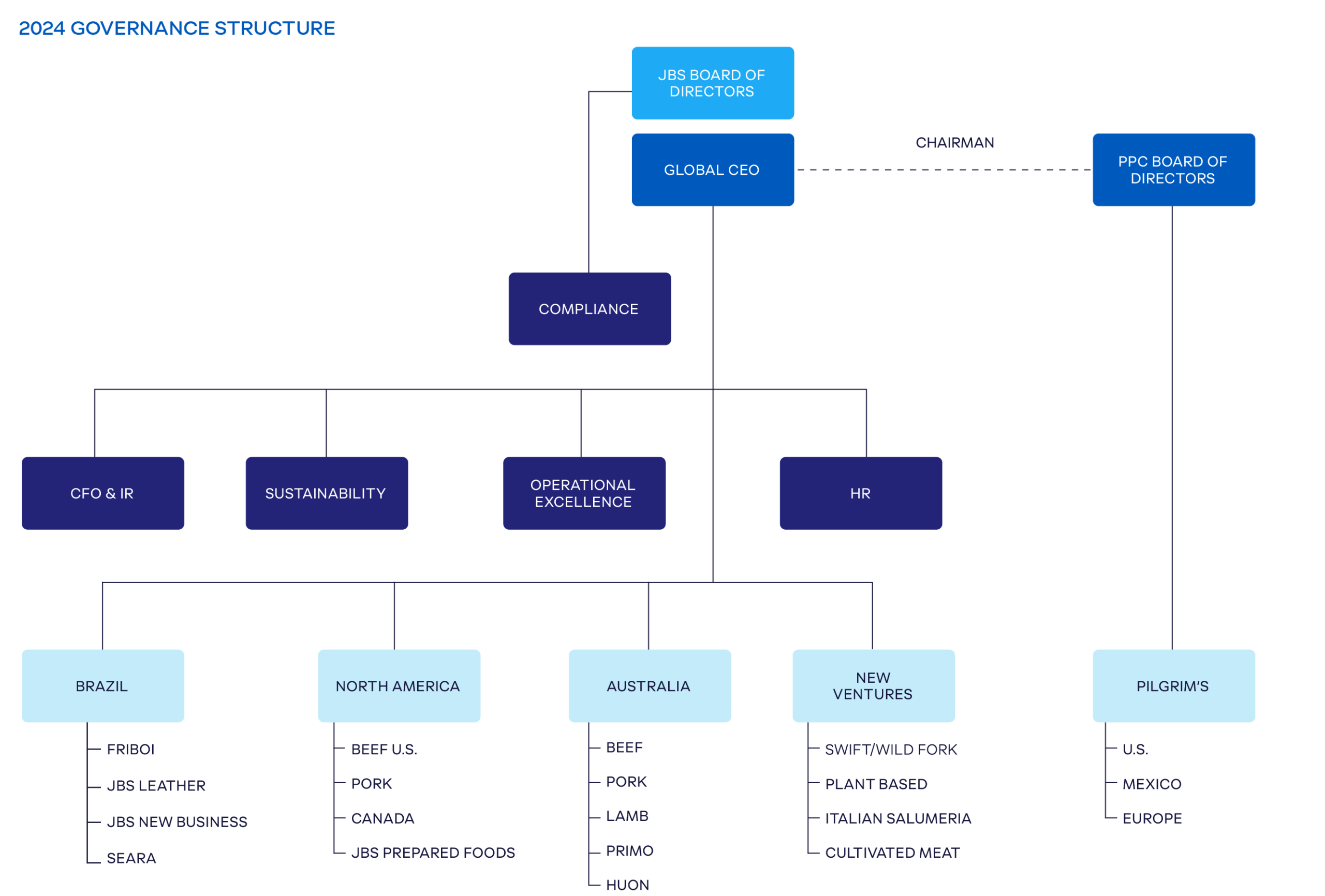

Management and Oversight

Governance Structure

(GRI 2-9)

At JBS, effective governance is fundamental to our corporate philosophy. It underpins our ability to deliver on our sustainability goals and create long-term value for all stakeholders. Our governance structure promotes responsible decision-making, transparency, and accountability across all levels of the company. We aspire to go beyond regulatory compliance by following rigorous internal policies, aligning with global frameworks, and upholding high ethical standards.

Continuous Learning and Development

At JBS, we recognize the importance of continuous learning for our Board, Executive Board, and Committees. To support their ongoing development, we promoted training whenever relevant or necessary – either through internal sessions led by team members with subject-matter expertise or through programs conducted by external advisors. Participation in annual training on the company’s Code of Conduct and Ethics was mandatory for all members of the Board, Executive Board, and Committees.

Learn more about our 2025 Board, Executive Board, and Committees on our Investor Relations website.

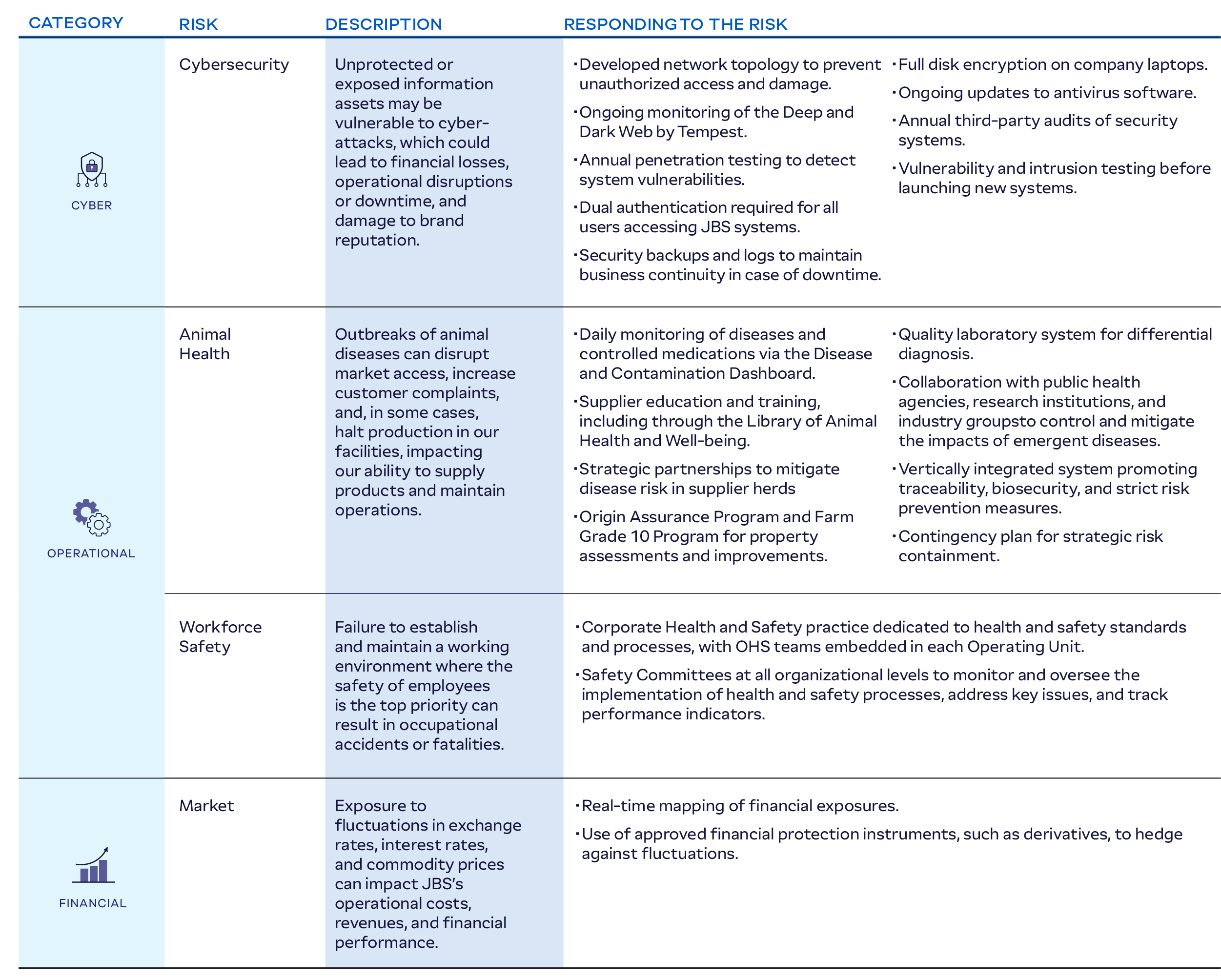

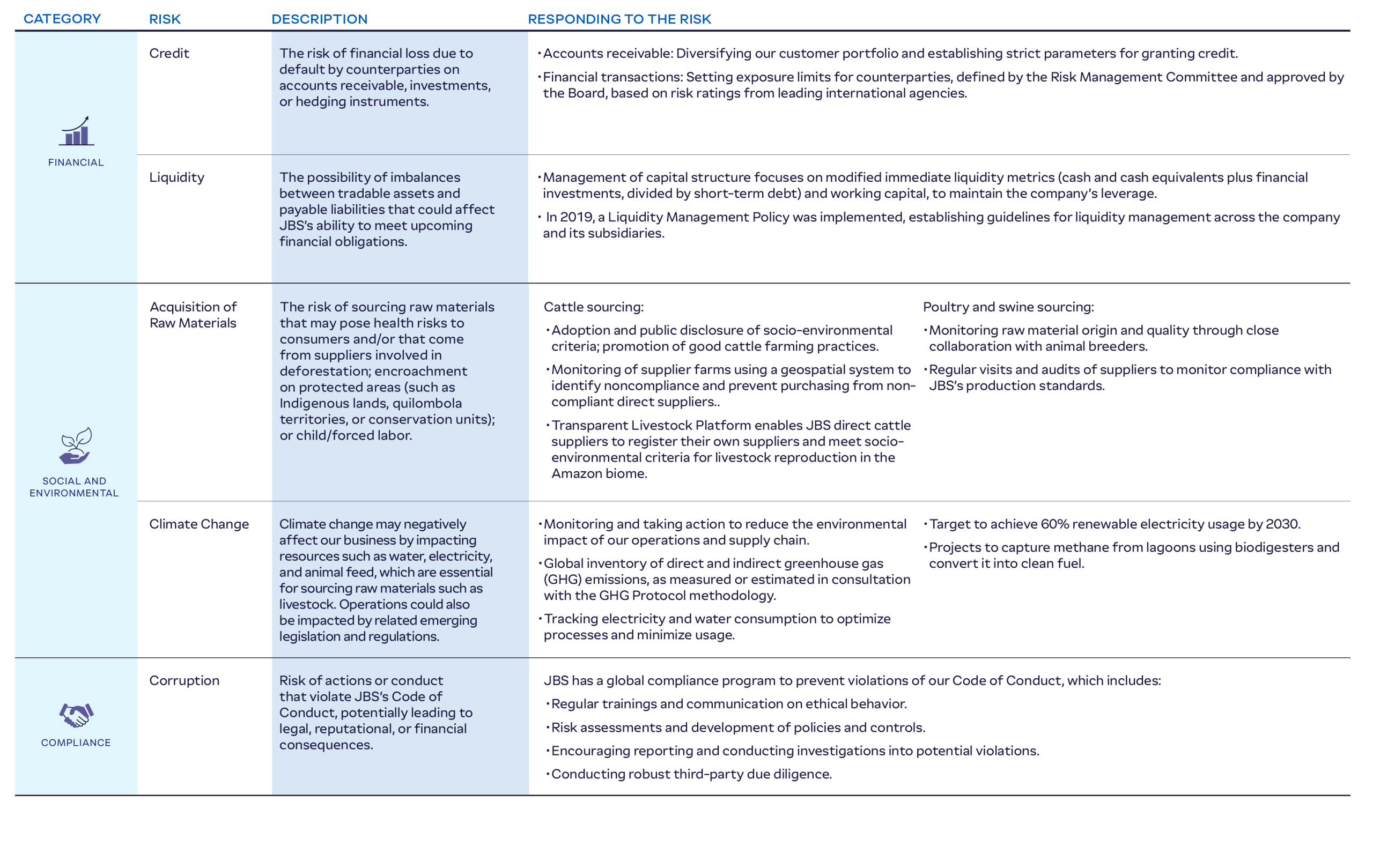

Risk Management

(GRI 403-2)

At JBS, we take a proactive approach to risk management across all levels of our operations. Our global risk management team operates under its own Risk Control Board, which is responsible for detecting, monitoring, assessing, and mitigating financial risks inherent to our operations.

The Risk Control Board has direct access to senior leadership through the Financial and Risk Management Committee, which advises the Board. This structure enhances our ability to identify and track financial risks – such as market, credit, and liquidity risks – as well as non-financial risks, including socio-environmental issues like climate change. Based on the Commodities and Financial Risk Management Policy approved by the Board, the Risk Control Board also supports our operational units in identifying and monitoring risks relevant to their activities, with support from specialized professionals and dedicated risk management systems.

Learn more about our risk management practices on our Investor Relations website.